RADIO

THE

BRAND

MULTIPLIER

Using audio advertising

to expand your brand

Radio: The Brand Multiplier uses theories presented in Byron Sharp’s How Brands Grow to reveal compelling new evidence about radio’s ability to drive strategic brand growth.

The findings reveal that audio plays an important and distinct role in enhancing the brand level effects of advertising and offer some practical guidance for advertisers seeking to optimise these effects.

The

Main

Findings

How radio promotes brand growth

1.Both audio-visual and audio advertising have a significant effect on helping brands spring to mind more readily in purchasing situations (salience)

2. When included in the mix, audio advertising significantly increases the effects of brand communication over audio- visual advertising alone:

a. Expanding a brand’s network of mental associations

b. Building brand associations amongst a wider audience

c. Increasing share of mind for a brand

3. When applied to broadcast media, these findings demonstrate how including radio alongside TV can improve the cost-effectiveness of brand campaigns

Findings

In Detail

Both Audio-Visual and Audio advertising

have a significant effect on a brand’s Network Size

Base: 2,732 category buyers (light/non-purchaser of test brands) making at least one association.

Source: d.fferento/ogy (2016).

To protect advertiser confidentiality data is shown unbranded.

Network Size, average across AV only and AV with Audio vs control

Network Size is the average number of Category Entry Points which respondents strongly associate with each brand, and it’s very clear that this has risen for each brand in the test after exposure to advertising, significantly in five out of six cases. This holds true both across people exposed to AV ads only and AV ads supplemented with Audio ads. So advertising – at least, linear real-time advertising – is demonstrated to help brands spring to mind more readily in purchasing situations by increasing Network Size.

(Note that some brands experience steeper increases than others – we explore how this effect can be optimised later).

Combining Audio ads with Audio-Visual ads

boosts Category Entry Point associations

Average network size across all brands

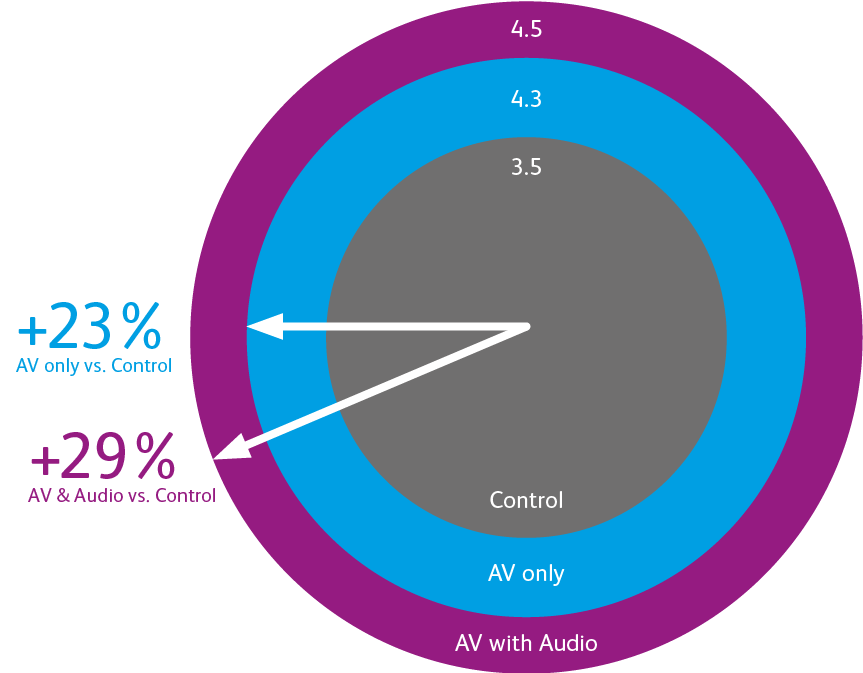

The average Network Size across the six test brands was 3.5 – in other words, respondents who were not exposed to any of the test advertising strongly associated the brands with an average of 3.5 Category Entry Points.

After exposure to audio-visual advertising alone, this

rose by 23%, but when audio advertising was added,

it increased by 29% – effectively adding one extra

Base: 2,732 category buyers (light/non-purchaser of test brands) making at least one brand association.

Source: d.fferento/ogy (2016).

Combining Audio ads with Audio-Visual ads

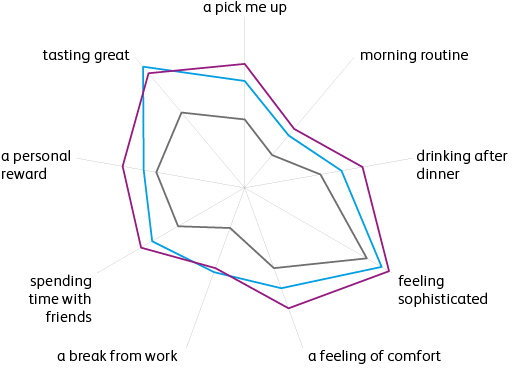

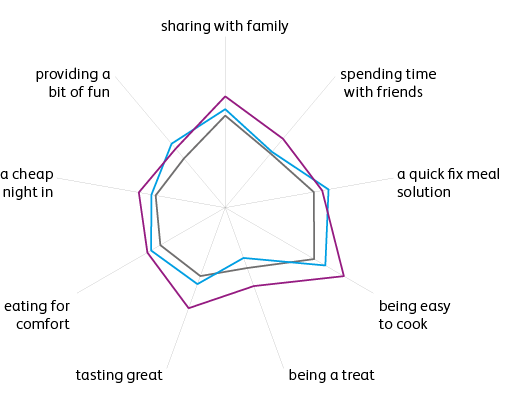

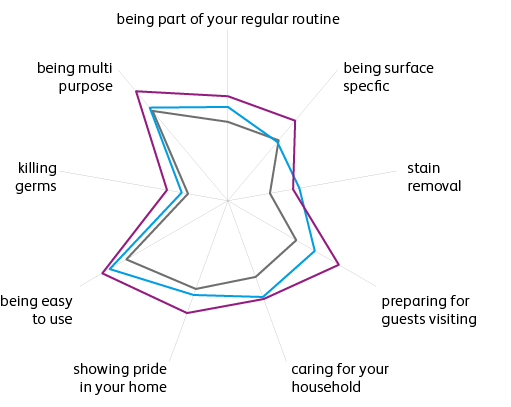

expands a brand’s network of mental associations

Base: 600 category buyers per brand (light/non-purchaser of test brands).

Source: d.fferento/ogy (2016).

- without advertising exposure (control group – grey line)

- after audio-visual ad exposure (test group 1 – blue line)

- after audio-visual and audio exposure (test group 2 – purple line).

The further the lines are from the centre, the greater the number of people who hold that association strongly between the brand and the CEP.

In this context we can see clearly that additional exposure to audio can expand

a brand’s network of mental associations further than audio-visual advertising alone.

Combining Audio ads with Audio-Visual ads

builds brand associations amongst a wider audience

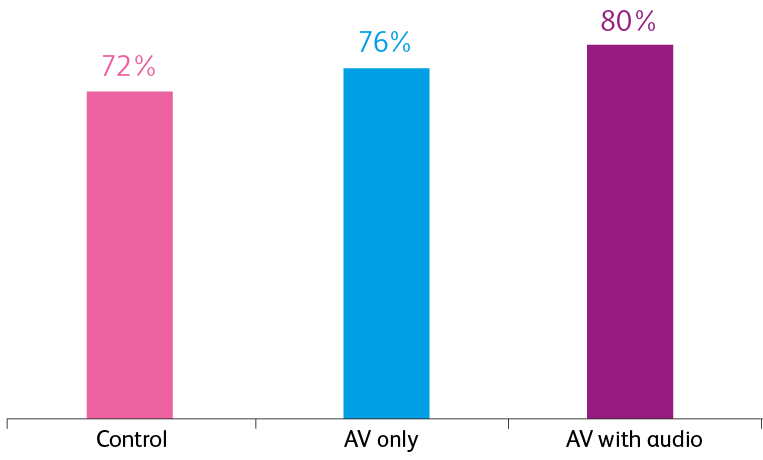

Mental Penetration, percentage of

category buyers with at least one CEP association

Mental penetration represents the percentage of people who strongly associate the brand with at least one Category Entry Point. As Network Size grows, we would therefore expect a parallel growth in Mental Penetration.

With well-known brands featured in this study, the base level was always going to be fairly high, with the result that it is harder to shift. But, as the graph shows, there has been a clear increase in Mental Penetration after audio-visual ad exposure, and even more when audio- visual ad exposure is supplemented with audio ads, with both steps statistically significant to 90% confidence levels.

Base: 3,600 category buyers (light/non-purchaser of test brands). Source: d.fferento/ogy (2016).

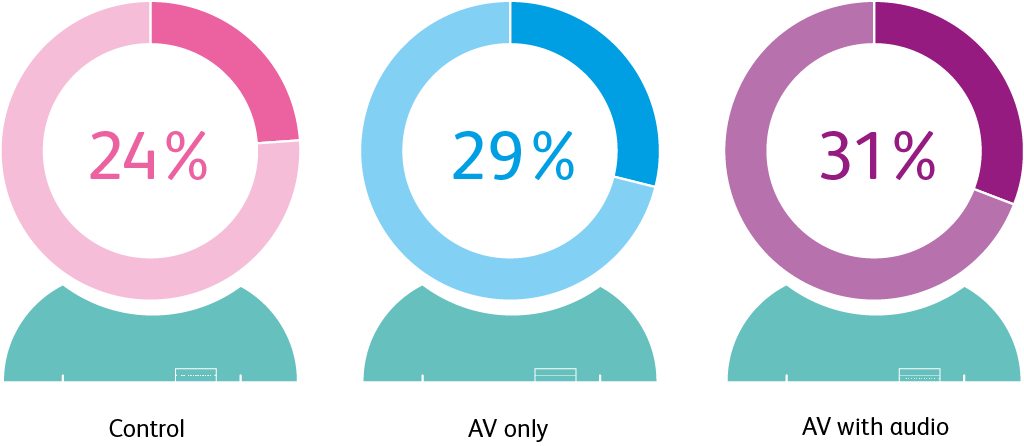

Combining Audio ads with Audio-Visual ads

boosts Share of Mind for brands

Share of Mind, percentage brand share of all CEP associations across the category

Base: 2,732 category buyers (light/non-purchaser of test brands) making at least one association.

Source: d.fferento/ogy (2016).

Share of Mind represents a brand’s percentage share of all CEP associations across the category (amongst those who have at least one CEP associative link to the brand). Once again, we would expect Share of Mind to increase in line with Network Size. This is supported by the data in the chart which shows that adding audio ad exposure further boosts the gain created by audio-visual advertising alone.

As with the previous measures this additional increase is statistically significant to 90% confidence levels.

The top-performing brand…

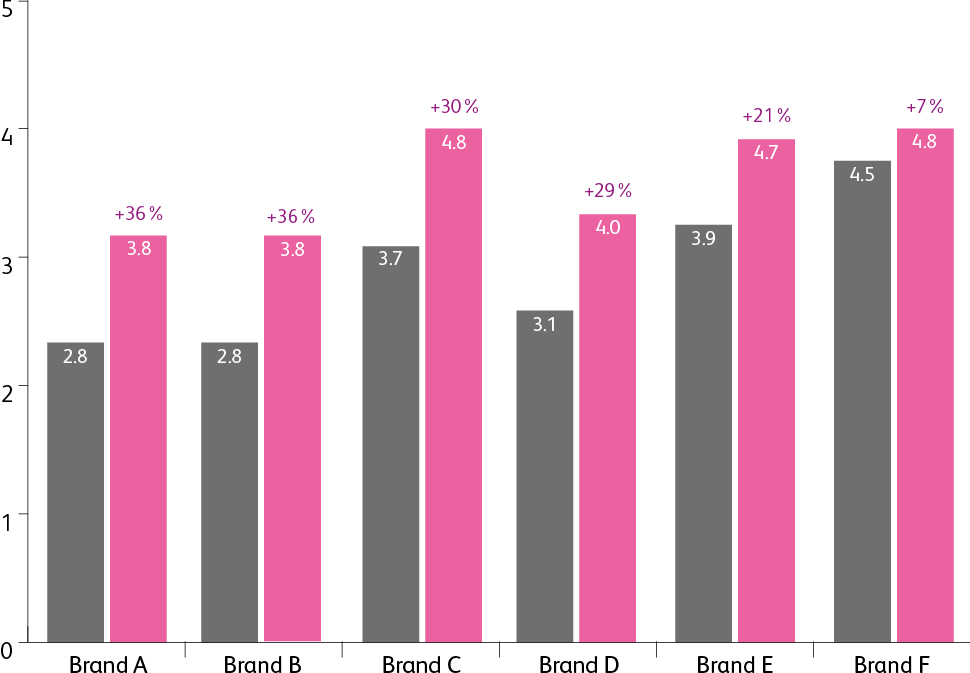

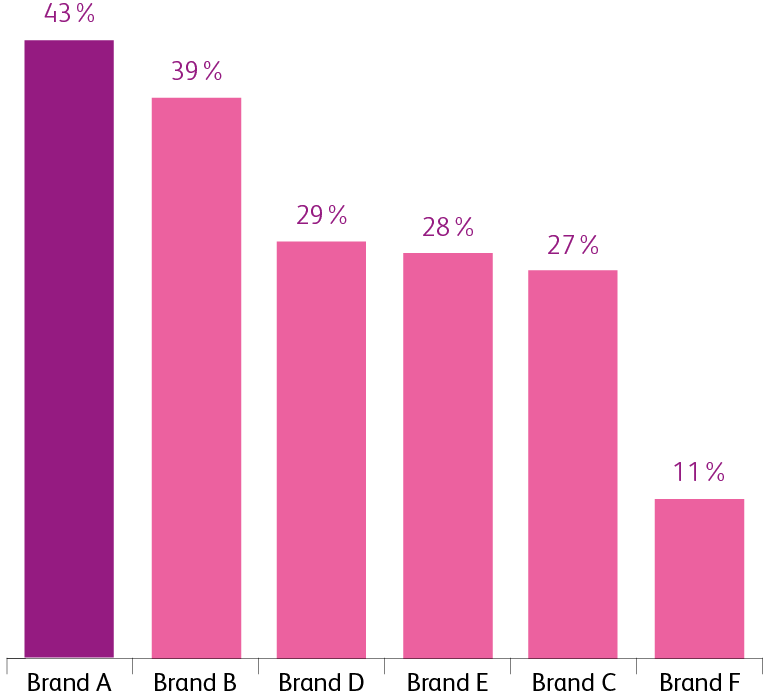

Increase in network size by brand, AV with Audio vs control

As we identified earlier, not all the brands in the test had the same results. The best performing brand saw its Network Size increase by 43% amongst those exposed to audio-visual supplemented with audio advertising compared to those in the control group not exposed

to any advertising – almost four times that of the brand with the lowest uplift. Some of the difference may be explained by different base levels of CEP associations but are there other factors that are influencing this?

The best performing brand saw

it’s Network Size increase by

43%

Base: 1,816 category buyers (light/non-purchaser of test brands) making at least one brand association.

Source: d.fferento/ogy (2016).

To protect advertiser confidentiality data is shown unbranded.

…uses the most distinctive audio brand asset

Base: 1,200 category buyers (light/non-purchaser of test brands) Control Group only.

Source: d.fferento/ogy (2016).

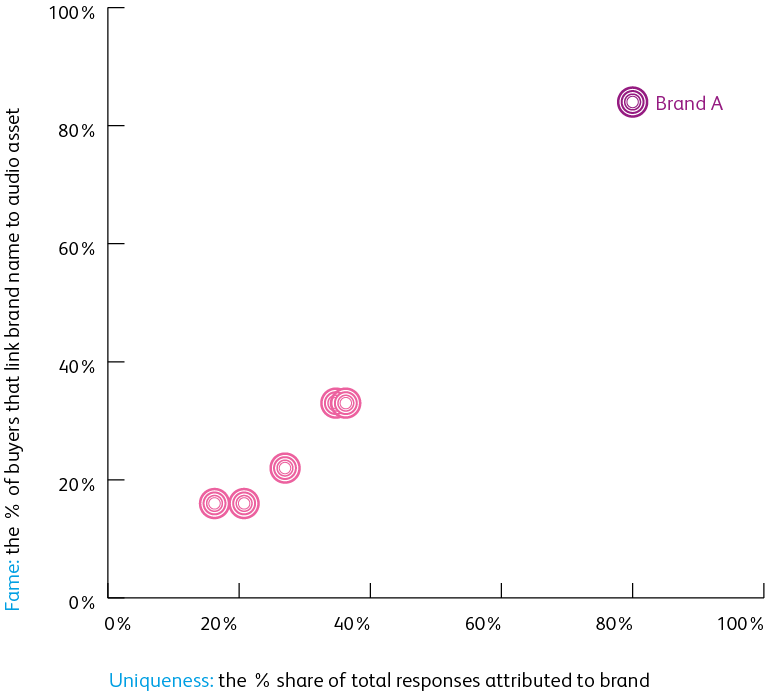

Relative strength of audio assets used by brands featured in the study

Part of the answer lies in the strength of the audio brand assets featured in the advertising. When we reviewed

the performance of the audio used in the ads it’s notable that the top performing brand has a sonic property which is widely recognised as unique to the brand, helping create synergy between the AV and audio campaigns and a strong link to the brand.

IMPLICATIONS

FOR ADVERTISERS

- Use radio to increase reach of brand activity

Firstly, it’s helpful to revisit one of the key elements of How Brands Grow, namely the importance of advertising reaching as many people as possible as continuously as possible. We know from IPA Touchpoints that adding a radio campaign into the media mix alongside TV extends overall campaign reach and allows the advertiser to speak to customers across the day and in different mind sets.

- Use distinctive audio brand assets to improve the brand’s presence

How Brands Grow identifies the value of using distinctive brand assets consistently over time for building mental availability. By revealing how using music consistently for brands increases familiarity and likeability of advertising leading to significantly higher levels of engagement, Radiocentre’s recent Strike a Chord study highlights the significance of using existing or developing new audio brand assets that can be used across media to drive brand effects further.

- Create multiple radio executions to associate the brand with more Category Entry Points

The study highlights how developing a range

of radio executions designed to trigger different CEPs to those triggered in existing advertising. Radio production costs facilitate this. Linking the brand successfully to more CEPs is identified as an important means of stimulating brand growth.

- Use radio to enhance cost-effectiveness of brand activity

The latest data from WARC (World Advertising Research Council) highlights how on average radio airtime is about a third of the price of TV, meaning that the test cell featuring audio alongside audio- visual (1 x AV + 2 x A) would be c. 15% cheaper to buy than the audio-visual only (2 x AV) test cell. This price difference helps deliver an improvement in cost-effectiveness of over 20% when considered alongside the additional increases across all mental availability measures observed in the test cell containing audio.

On this basis, it’s clear that beyond just extending reach, including audio in the mix can also significantly improve the overall cost-effectiveness of brand- building campaigns. This is interesting to consider alongside the findings from Radiocentre’s Radio, the ROI Multiplier research which highlights how overall campaign return on investment is optimised when radio is allocated 20% share of the total budget.

In summary, if you’re seeking to strengthen your brand this study highlights the distinct and effective multiplier role that radio can play within the mix.